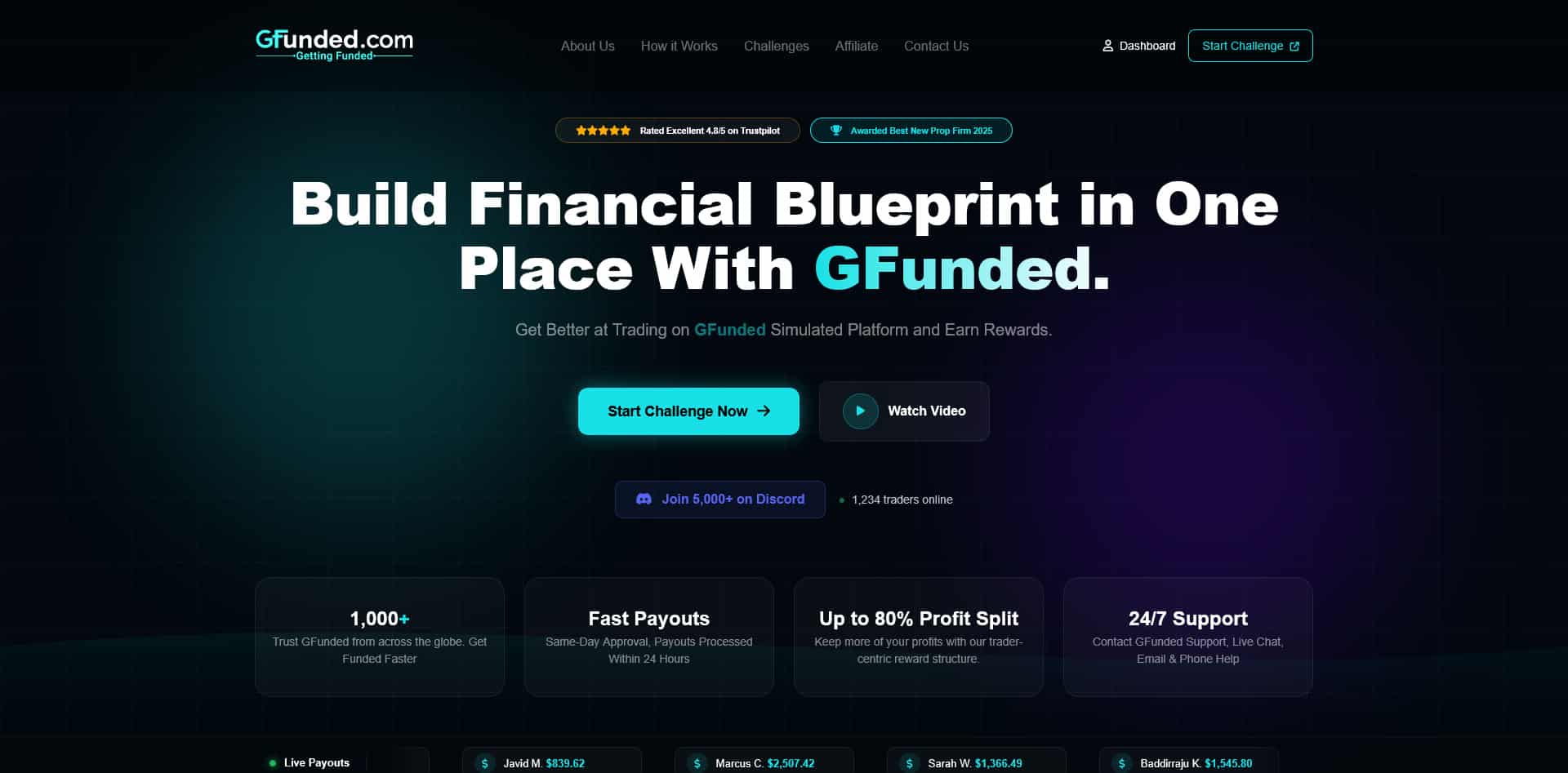

GFunded Best Prop Trading Firm stands out from its competitors with remarkable features, diverse account sizes, competitive fees, and attractive payout terms. Their impressive 4.8/5 rating on Trustpilot and title as the Best New Prop Firm 2025 speak volumes about their service quality. You might want to consider GFunded if you’re searching for a prop trading firm with exceptional conditions.

More than 1000 traders worldwide have put their trust in GFunded Best Prop Trading Firm, and with good reason too. They offer generous profit splits up to 80% and quick 24-hour payout processing. Traders can scale their accounts up to $2M through the scaling plan. The firm operates globally, but traders from the US and Canada won’t be able to access their services.

This piece breaks down everything about GFunded – from evaluation processes to available account types. You’ll learn about their trading rules, including the 10% profit target, 4% daily loss limit, and 6% maximum loss requirements. Account sizes range from $10,000 to $200,000 with pricing options between $95 and $925. New prop traders and those looking to switch firms will find this guide helpful to decide if GFunded fits their trading goals.

GFunded evaluates traders through a well-laid-out process that spots disciplined and profitable traders. Prop trading lets you use the firm’s money instead of your own. You’ll share profits based on agreed terms. The core team at GFunded Best Prop Trading Firm tests your trading skills through multiple stages with specific rules.

The GFunded Challenge is your original test that shows what you can do as a trader. You get a simulated trading account with virtual funds. The main goal is to hit a profit target of 8-10% of your account value. You’ll need to follow strict risk management rules.

Your success depends on staying within these key limits:

These rules help find traders who make steady returns rather than getting lucky. GFunded Best Prop looks for traders who show discipline, patience, and solid risk management. These qualities matter a lot at the time you handle big money.

The Challenge has no time limit. You can reach your profit target at your own speed. This helps you trade carefully instead of rushing into bad decisions. After meeting all goals and passing the review, you move to the next stage.

Success in the Challenge takes you to the Verification Phase. This second stage proves that your good performance wasn’t just luck but real trading skill.

The Verification Phase keeps the same risk rules as the Challenge. The profit target drops to half of what you needed before. To name just one example, a 10% Challenge target would mean about 5% for Verification. This lets GFunded Best Prop Firm see if you can make money steadily while following their rules.

Like the Challenge, you won’t face any time pressure to finish the Verification. This setup helps you focus on steady trading instead of taking big risks to beat deadlines. The lower profit target shows that smart trading needs patience more than aggressive moves.

Passing both evaluation stages earns you a funded trading account with GFunded Best Prop Trading Firm. This is a big deal as it means that you’ll trade the firm’s money and share the profits you make.

A funded account typically splits profits 80/20 – you get 80% and the firm takes 20%. You make good money without risking your own cash. The firm processes payouts every 14 days.

GFunded‘s model includes chances to grow. Good traders can boost their account size by 25% every four months. This growth path lets successful traders handle bigger accounts and earn more as they prove themselves.

You’ll need to complete a KYC check before your first payout. This means showing government ID, taking a live selfie, and proving your address with recent documents like utility bills or bank statements.

Funded traders must stick to the same trading rules from the evaluation. The firm watches your account to make sure you follow drawdown limits and other risk rules.

GFunded Best Prop Trading Firm has account options that work for traders at every level and budget. You need to know how these evaluation models work to pick the right path to funded trading. Let’s look at the different accounts and what makes each one special.

One-step evaluation programs give you the quickest path to funded trading. These simplified accounts need you to pass just one evaluation phase to get funded capital. You’ll need to hit an 8-10% profit target while staying within maximum loss limits of 5-6%.

One-step accounts shine because they’re simple and quick. The profit targets are lower than multi-stage evaluations, which makes them a great value for traders who want to prove their skills fast. On top of that, many firms give you back your fees when you pass the challenge.

gfunded

Most one-step programs include:

Premium one-step challenges like the “Stellar 1-Step” need a 10% profit target with strict 3% daily loss and 6% maximum loss requirements. Some firms offer better terms with profit splits up to 95% for traders who make it.

Two-step evaluation models split the testing into two parts: an original challenge and a verification stage. This lets firms get a full picture of how consistent traders are and how well they manage risk in different market conditions.

The first phase usually needs an 8-10% profit target, while the second phase aims for 4-5%. Two-step programs give you more room to work with higher overall drawdown allowances (8-10%) compared to single-phase challenges.

Popular variations include:

Two-step programs need at least three trading days per phase. Traders who like to take their time and show steady performance over a longer period prefer this option.

Instant funding is the fast track of prop trading. You get funded accounts right away without any evaluation phases. This option costs more than challenge-based programs, but you can start trading immediately.

The instant funding model comes with clear benefits:

Programs like “Stellar Instant” use a 6% trailing drawdown, while other “Instant Funding” options have 10% maximum drawdown limits and 80% profit splits. The “IF1” account offers 90% profit splits but keeps a tight 4% maximum drawdown rule.

GFunded Best Prop Firm has special accounts just for cryptocurrency traders. These plans work well with crypto’s unique price swings and trading patterns.

Crypto-specific programs usually include:

Kraken’s “Breakout” program shows what high-end crypto trading can look like, with up to $200,000 in trading capital and 5x leverage just for BTC and ETH trading. These plans work best for traders who stick to cryptocurrency markets instead of traditional ones.

GFunded Best Prop Trading Firm adjusts its pricing based on account size, evaluation type, and extra features. Account sizes run from $5,000 to $200,000, with fees ranging from about $50 to $1,250 depending on what you choose.

Success with GFunded Best Prop Trading Firm starts with mastering their trading rules. These parameters work as strategic guardrails that help you become a disciplined trader and protect your capital. Let’s get into the key regulations that shape your experience with GFunded Best Prop Firm.

Profit targets work as performance filters that separate disciplined traders from inconsistent ones. Most prop challenges, including those at GFunded Best Prop, set targets between 8-10% to verify that your gains come from skill rather than oversized positions. This helps identify traders who fit with long-term risk standards.

Maximum drawdown rules tell you how much you can lose from your original balance. GFunded Best Prop Trading Firm usually sets overall drawdown limits at 10% of your starting balance. To cite an instance, a $100,000 account should maintain a balance above $90,000 throughout the evaluation. This rule will give a solid foundation for capital management and risk control.

Daily loss limits help prevent your account from crashing in a single trading session. Most prop firms, including GFunded Best Prop, use daily limits between 4-5% of your original account value. This keeps traders from taking big risks in one day and maintains steady portfolio performance.

The standard daily drawdown sits at about 5%, which balances trading freedom and capital protection. You must also trade regularly. Your account will fail automatically if you don’t place trades for 30 days. This rule makes sure that only active traders keep using firm capital.

GFunded Best Prop Trading Firm lets you choose between trailing and static drawdown based on your account type. Static drawdown stays fixed whatever profits you make. To cite an instance, an account worth $100,000 with 8% static drawdown must stay above $92,000—even after growing to $120,000.

Trailing drawdown changes as your account grows. When your account hits $110,000, a 10% trailing drawdown moves your limit up to $99,000 (10% below peak). This helps traders protect their profits.

Yes, it is a big difference—static drawdown gives you more room to risk as profits grow, while trailing drawdown tightens your limits as your account increases. Your choice between these options shapes how you trade and manage risk.

GFunded Best Prop doesn’t force you to use stop-loss orders on every trade, but they are a great way to get better results. You must keep position sizing steady—repeatedly “going all in” or risking large chunks of your account on single trades will trigger reviews and possible termination.

The firm watches out for unrealistic trading practices, especially high-frequency strategies. Your trades need to meet minimum value-weighted holding times—accounts holding trades less than 2 minutes face review. High-frequency strategies with 0-15 second trades are not sustainable and lead to account termination.

These rules promote professional discipline rather than restrict traders. Understanding and following GFunded Best Prop Trading Firm’s risk parameters puts you on track for long-term success in the ever-changing world of proprietary trading.

Traders at GFunded Best Prop Trading Firm need to know how to access their earnings, not just make profits. The firm’s payout structure gives traders competitive profit sharing and easy withdrawals. This creates reliable income streams.

GFunded Best Prop Trading Firm lets traders request payouts based on their account type. You can request withdrawals after showing good performance – you need 5 winning days with daily profits of $100 to $300 depending on your account size.

Standard accounts have a 14-day payout window that starts with your first trade. This helps you plan your withdrawals better. Rapid Plans and other special accounts give you better options, with payouts available daily after market close.

Each account type has its own withdrawal limits:

Your maximum withdrawal limits grow as you perform well. Scale Plan accounts with $50k start at $1,500 and can reach $3,500 by the fifth payout.

You must complete KYC verification before your first withdrawal. This step keeps trading operations safe and compliant.

Here’s what you need to do:

You’ll need one valid ID – government-issued ID, passport, permanent residence permit, or driver’s license works. You must also take a live “selfie” to prove you’re a real person.

KYC verification takes 24-48 hours after you submit documents. Once verified, future withdrawals become quick and simple.

GFunded Best Prop Trading Firm gives successful traders much of their generated profits. Standard accounts get an 80% profit share, though percentages vary by account type.

Special plans offer even better terms:

Many prop firms use tiered profit splits that improve with performance. Your profit split might start at 30% and grow to 70% after three approved payouts. It can reach 99% after six or more successful withdrawals.

Your withdrawal strategy affects your account’s drawdown limits. After your first payout, your maximum loss limit stays at your starting balance plus $100. A $50,000 account would lock at $50,100.

Firms often need you to hit a “buffer target” before withdrawals. A $50k account might need a $2,100 buffer target first. This policy keeps enough capital in your account after withdrawals.

Big profit withdrawals can put you close to drawdown limits. Take a $50k account that reaches $53,000. If you withdraw $1,500, your balance becomes $51,500. This leaves just $1,400 in drawdown cushion with a $50,100 limit.

Some accounts let you manage this risk better. Pro accounts might let you take 60% of profits before clearing the buffer. This balanced approach gives you access to earnings while keeping your account stable.

GFunded Best Prop Firm’s trading success depends on their strong technology and platform choices. Traders can choose from several advanced trading platforms that match different trading styles and priorities.

GFunded Best Prop Trading Firm gives you access to these leading platforms:

Each platform stands out with its own special features. cTrader shines with its modern interface and advanced charting tools – perfect for technical traders. MetaTrader 5 lets you customize everything through its powerful ecosystem of indicators and expert advisors. DXtrade and Match-Trader complete the lineup with their user-friendly design and specialized features.

Raw spreads start at just 0.0 pips, making trading costs highly competitive. The platform processes orders at lightning speed to minimize slippage and execute trades at your desired prices.

GFunded Best Prop keeps their fee structure clear and simple. They don’t mark up spreads, swaps, or commissions beyond standard fees. Remember that overnight positions come with swap fees that change based on the instrument and market conditions.

You can trade multiple asset classes with up to 1:100 leverage at GFunded Best Prop Firm. These include:

This wide range lets traders apply their strategies in markets of all types and grab opportunities as they appear. Each instrument type has its own leverage limits, with forex pairs getting the highest allowances.

GFunded Best Prop Trading Firm stands out from competitors with its flexible policies on news trading and weekend positions. Most accounts let you trade crypto pairs, indices, and select instruments during weekends. This feature helps you profit from weekend price movements and protects against unexpected Sunday market gaps.

Weekend trading works especially well with cryptocurrency pairs. You can trade over 40 crypto pairs non-stop through weekends. Their relaxed approach to market news events gives you more freedom than firms that restrict trading during major economic announcements.

GFunded Best Prop Trading Firm gives traders excellent scaling opportunities. Their programs create clear paths to higher capital and better earnings for dedicated traders.

GFunded Best Prop lets traders scale their accounts through consistent performance. Their scaling plan has helped traders grow from $50K to $200K funded accounts in just 6 months. GFunded’s approach is different from competitors who use fixed timeframes. Traders can ask for scaling at every 10% of simulated profit without minimum time requirements. This rewards skill over time spent trading.

GFunded Best Prop increases profit splits with each successful withdrawal:

| Payout Number | Trader’s Share | Firm’s Share |

|---|---|---|

| First payout | 60% | 40% |

| Second payout | 70% | 30% |

| Third payout | 80% | 20% |

| Fourth+ payouts | 90% | 10% |

This tiered system means your $5,000 profit earns $3,000 on first payout, but by the fourth payout, you would earn $4,500 from the same profit.

GFunded Best Prop Trading Firm knows trader success benefits everyone. Premium programs provide extra advantages with customized performance coaching that helps overcome psychological barriers, trading habits, and execution issues. These programs help traders build emotional stability and disciplined approaches that lead to consistent results.

GFunded Best Prop Trading Firm stands out as a great choice for traders who want reliable paths to funded accounts. The firm sets itself apart with profit splits up to 80% and quick 24-hour payouts. On top of that, their scaling plan gives traders a chance to grow accounts to $2 million through steady performance.

The multi-stage evaluation process is tough but focuses on finding traders with real discipline rather than lucky ones. This approach will give access to large capital only to skilled traders. GFunded’s flexible options fit different trading styles and risk appetites – from one-step evaluations to two-step models and instant funding.

The risk parameters might look strict at first – 10% profit target, 4% daily loss limit, and 6% maximum loss requirements. But these guardrails protect both the firm’s and trader’s interests from big losses. The mix of trailing and static drawdown options lets traders manage risk based on their strategy.

GFunded’s reward system really shines through consistent performance rewards. Your share grows from 60% to 90% as you stack successful payouts. This creates huge earning potential without putting your own money at risk.

Think about your trading style, capital needs, and risk tolerance before picking any prop trading firm. GFunded Best Prop Trading Firm definitely has attractive terms for disciplined traders who follow the rules. Prop trading goes beyond just getting capital – it helps you build professional trading habits that lead to lasting market success.

GFunded offers a structured path to funded trading with competitive terms that reward disciplined traders through progressive profit splits and rapid payouts.

• GFunded provides up to 80% profit splits with 24-hour payout processing and scaling opportunities up to $2M accounts • Evaluation requires 10% profit target with 4% daily loss and 6% maximum drawdown limits across multiple account types • Profit splits increase from 60% to 90% with each successful withdrawal, maximizing long-term earning potential • Multiple platforms (cTrader, MT5, DXtrade) support 40+ crypto pairs, forex, indices with up to 1:100 leverage • Flexible scaling allows account growth at every 10% simulated profit without minimum time requirements

GFunded’s combination of competitive terms, flexible evaluation options, and progressive reward structure makes it particularly attractive for traders seeking professional capital access without the typical restrictions found at other prop firms.

Q1. What are the profit split percentages offered by GFunded Best Prop Trading Firm? GFunded offers a tiered profit split structure that increases with each successful payout. It starts at 60% for the first payout, progresses to 70% for the second, 80% for the third, and reaches 90% for the fourth and subsequent payouts.

Q2. How does the scaling plan work at GFunded Best Prop Trading Firm? GFunded’s scaling plan allows traders to grow their accounts based on performance. Traders can request scaling at every 10% of simulated profit without minimum time requirements. This approach has enabled some traders to grow from $50K to $200K funded accounts in just 6 months.

Q3. What are the key trading rules at GFunded Best Prop Trading Firm? GFunded implements a 10% profit target, 4% daily loss limit, and 6% maximum loss requirement. They also have rules against high-frequency trading and maintain a minimum value-weighted holding time threshold for trades.

Q4. Which trading platforms does GFunded Best Prop Trading Firm support? GFunded provides access to several trading platforms including cTrader, MetaTrader 5, DXtrade, and Match-Trader. Each platform offers unique features tailored to different trading styles and preferences.

Q5. What is the payout schedule at GFunded Best Prop Trading Firm? For standard accounts, the payout window refreshes every 14 calendar days from the first trade. Some specialized accounts, like Rapid Plans, offer more frequent payout options. Traders can typically request withdrawals after achieving 5 winning days with minimum daily profits ranging from $100 to $300, depending on the account size.