GFunded Prop Firm has become a game-changer in the trading world. The platform now supports over 400,000 funded traders and has paid out more than $10M to its traders.

The retail prop firm started its journey in 2021. It gives traders a chance to access large capital pools once they clear evaluations on simulated accounts. GFunded.com keeps things simple with a one-time fee structure. Traders can start with accounts ranging from $10,000 to $200,000, paying between $95 and $925. Their stellar 4.8/5 rating on Trustpilot shows why traders around the world trust this platform.

Traders who review GFunded often talk about its 10% profit target needed to pass evaluations. The platform has clear risk rules that include a 4% daily loss limit and 6% maximum drawdown. These rules aren’t random restrictions. They help find disciplined traders who know how to manage risk well.

We tested several GFunded Prop Firm accounts from $50K to $400K to bring you an honest review. Our goal is to show you what works and what doesn’t, so you can decide if this platform matches your professional trading goals.

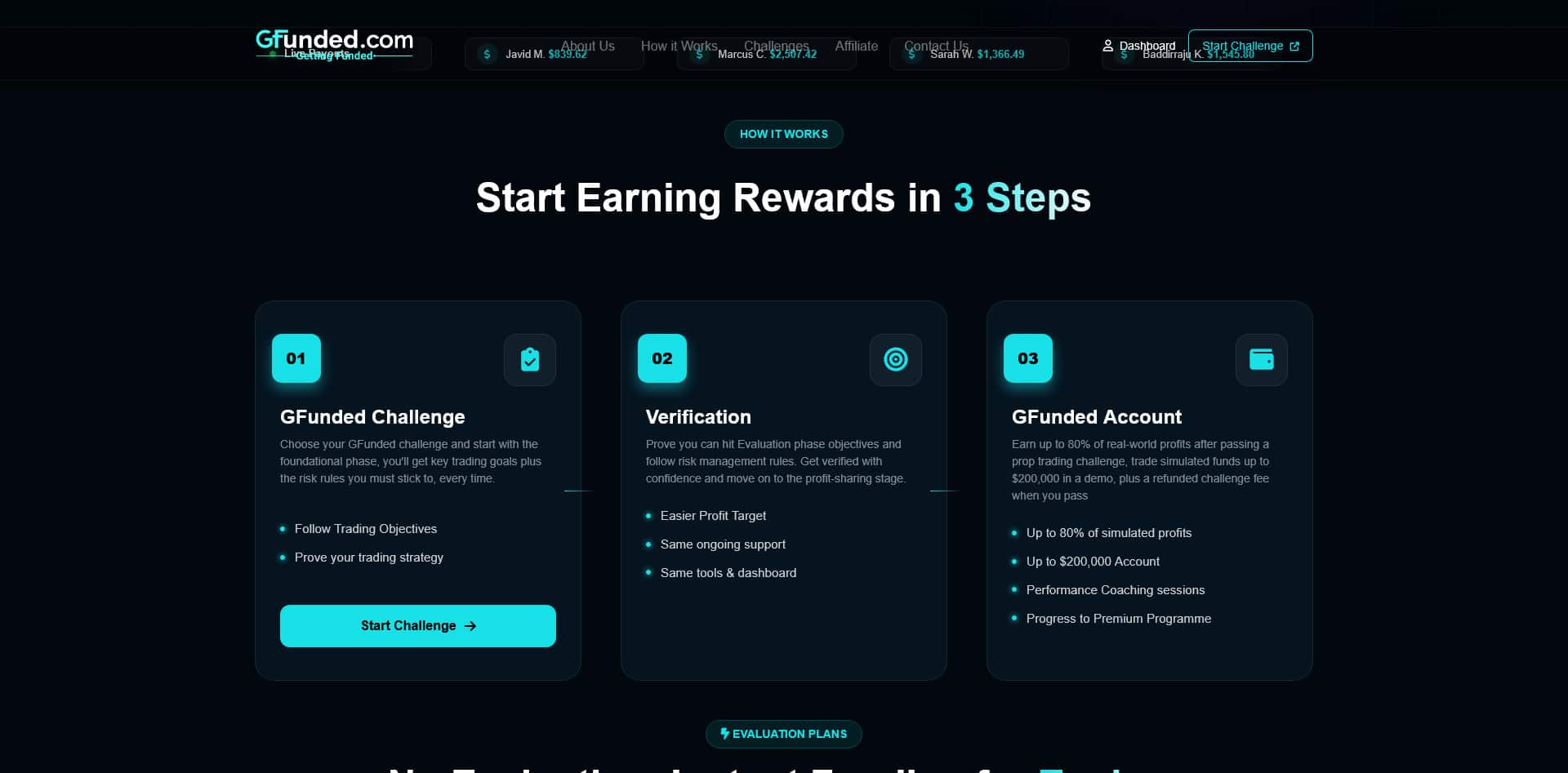

GFunded works differently from regular trading where you risk your own money. They use the retail prop firm model to give traders simulated accounts worth $10,000 to $200,000. The best part? Your trading skills, not your bank balance, determine how much you can earn.

GFunded creates simulated trading environments that match real market conditions without putting your money at risk. You won’t use actual market capital during evaluation. Instead, you’ll show your trading skills in a controlled environment that mirrors live market behavior.

This model stands out because while you trade in a simulated environment, you can withdraw real profits. After passing the evaluation and getting a funded account, GFunded puts their capital behind your trades. You earn real money based on how well you perform. It’s a perfect setup – traders get bigger accounts without risk, and GFunded finds talented traders to support.

GFunded keeps things simple with a one-time fee that sets them apart from competitors. You pay once upfront to join their evaluation program, unlike other platforms that charge monthly fees. This single payment lets you prove your skills and earn real profits.

The fee changes based on your chosen account size – bigger accounts cost more. This pricing approach gives traders several benefits:

Traders can focus on building consistent, disciplined habits instead of rushing to meet monthly targets.

GFunded offers two ways to get funded: traditional evaluation programs and instant funding. Each option fits different trader needs:

Evaluation Programs:

Instant Funding:

Both options help GFunded achieve its main goal: finding skilled traders who make consistent profits while managing risk well. The evaluation model builds discipline and filters out risky trading, while instant funding works for experienced traders who want immediate access.

GFunded gives traders a platform to use much bigger capital than they could risk personally. Consistent, skilled traders can earn good money, no matter how much they start with.

GFunded’s three account types fit different trading styles and risk levels. Each type has its own benefits based on how you trade. I’ve tested all three options with both $50K and $200K accounts to see how they work in real trading.

The 1-Step evaluation is the quickest way to get funding if you can handle stricter rules. You need to pass just one phase with a 10% profit target while staying within daily and maximum drawdown limits. Here’s what makes it great to get quick funding:

The catch is you’ll face tighter consistency rules, around 20%. This means your daily profit can’t go above 20% of your total profits. You can’t rely on one lucky trade to carry your account. A $50K account needs $5K in profits without going past a 6% maximum drawdown (about $3K).

The pressure of a single evaluation means you need rock-solid discipline. One trader told me, “The 1-Step saved me time, but forced me to be much more selective with entries.”

The 2-Step evaluation splits the challenge into two easier phases. Many traders find this mentally easier to handle. You’ll get:

With a $200K account on a 2-Step plan, you’ll need $16K profit (8%) in Step 1, then $12K profit (6%) in Step 2. This setup helps you build confidence as you go.

The 2-Step evaluation feels more like real funded trading because it breaks things into clear goals. This helps you develop good trading habits that last.

Instant Funding accounts let you start trading right away without evaluation phases. It’s convenient but comes with stricter rules:

A $100K Instant Funding account might limit daily losses to 3% ($3K) with a maximum drawdown of 6% ($6K). Once you make 4-10% profit (depends on the plan), your account can’t drop below your starting amount.

Early wins actually make your position safer by locking in protection against losses. Some plans need 5-7 trading days before you can take profits, and those profits must be a certain percentage of your starting balance.

You don’t have profit targets to worry about, but the strict loss limits create their own challenges. Instant Funding costs more upfront because you get immediate access and the firm takes on more risk.

Pick the plan that matches your trading style, risk comfort level, and personal priorities. The best choice isn’t always the fastest or cheapest – it’s the one that fits how you trade.

Success or failure in GFunded trading depends on your ability to become skilled at a set of rules. You need to understand these parameters to avoid account closures and boost your chances of getting funded.

The life-blood of GFunded’s evaluation lies in reaching a profit target – usually 10% of your account balance. This target stays the same whatever your account size, though the actual dollar amount changes substantially. A $50K account needs $5,000 in profits, while a $200K account must reach $20,000 before you qualify for funding.

You should know that rushing to meet this target often spells disaster. Successful traders take their time and focus on steady small gains instead of chasing quick profits. To cite an instance, see a $200K account – if you average $1,000 daily, you’ll hit your target in about 20 trading days. This timeline helps reduce pressure and promotes disciplined trading.

GFunded uses two main risk controls: daily loss limits and maximum drawdown. Daily loss limits usually run between 3-5% of your account balance. This creates a strict cap on single-day losses. A $100K account might have a $3,000-$5,000 daily limit. Even a tiny breach of this limit can disqualify you right away.

Maximum drawdown limits typically range from 8-12% of your original balance. This gives you more room to handle cumulative losses. Take a $50K account with a 10% maximum drawdown – your account closes if it drops to $45,000 or below. These rules protect both you and the firm by enforcing disciplined risk management and stopping emotional revenge trading.

GFunded calculates drawdown in two distinct ways:

Static Drawdown: This stays fixed at a set percentage of your original balance, no matter your profits. A $100K account with an $8,000 static drawdown can never drop below $92,000 – even if your balance grows to $110,000.

Trailing Drawdown: This moves up as your profits grow. Picture a $100K account with an $8,000 trailing drawdown. If your balance hits $104,000, your new drawdown limit becomes $96,000 and stays there even when your balance falls.

Trailing models reward consistency but leave less room for error as you progress. Static drawdown offers more flexibility after early wins, making it ideal for swing trading strategies that need space for market swings.

The difference between equity and balance tracking is vital to avoid breaking rules by accident:

Balance: Shows only closed trades, ignoring open position profits or losses.

Equity: Combines unrealized profits/losses from open positions with your current balance.

So if GFunded measures drawdown based on equity (as many firms do), your account might breach limits from temporary drawdowns in open positions – even if you never close those losing trades. This matters especially for overnight positions where market gaps could trigger violations before you can react.

This rule states that no single day’s profit can exceed 20% of your total profits. It stops traders from hitting targets through lucky trades instead of showing real skill. Let’s say your total profit is $10,000 – your biggest single-day profit must stay under $2,000 (20% of $10,000).

Here’s how to check if you comply:

A $3,000 profit day means you need at least $15,000 in total profits ($3,000 ÷ 0.20) before requesting a payout. Even after hitting your original profit target, you might need more trading days to meet consistency requirements.

This rule helps manage risk and ensures traders develop green practices instead of relying on risky gambling approaches.

Traders can get disqualified from funded programs for breaking rules that aren’t obvious. These hidden requirements can derail promising careers, even when profit targets and drawdown limits are met.

Prop firms want traders to prove themselves over multiple days rather than getting lucky with one big trade. Most evaluation accounts need 3-7 trading days. Funded accounts also need to trade regularly for each payout cycle. Some firms take it further and ask traders to make at least 0.5% profit of their original balance on these days to qualify.

The logic makes sense – consistency beats one-time wins. When traders show they can make money across different sessions, it proves their strategy works and isn’t just good timing.

Not trading enough can get you kicked out too. Your account gets flagged as inactive if you don’t make at least one trade within a set time (usually 30 days). This applies to both evaluation and funded accounts. Once you break this rule, there’s no coming back.

These rules exist because prop firms run thousands of accounts at once. Each account uses system resources and platform infrastructure. Dead accounts just take up space and slow things down.

A simple fix for traders taking breaks is to place a tiny trade before the inactivity timer runs out. Some firms might pause this rule if you ask, but it depends on who you’re trading with.

Trading around major economic news can get you in trouble. Most firms won’t let you open or close positions 2 minutes before and after big economic announcements. This covers everything – manual trades, stop-losses, take-profits, and pending orders during this time window.

Break these news trading rules and your account is gone, no matter how profitable you are. Firms have this rule because demo environments can’t match the crazy volatility and price gaps that happen during major news.

You need a stop-loss on every trade – that’s non-negotiable with most prop firms. GFunded calls this a “soft breach”, so you won’t lose your account right away. But if you keep forgetting stop-losses, you might still get disqualified after review.

This isn’t just some random rule. It’s about being a professional trader who knows how to manage risk. Without stop-losses, you’re exposed to huge losses when markets make unexpected moves or gap overnight.

These rules show what prop firms really want – traders who are consistent, disciplined, and handle risk like professionals in everything they do.

GFunded’s pricing structure stands out with its transparent and one-time payment model. Traders need a clear understanding of total costs to avoid surprises later.

The company uses a tiered pricing structure based on account size. Larger accounts need higher investments. A Standard Plan-4 $50K account costs $375 one time. This gives you access to a simulated account without minimum trading day requirements. The account comes with a 10% profit threshold, 5% daily loss limit, and 6% maximum loss limit.

Traders who want more capital can opt for the $200K account. The documents don’t specify GFunded’s exact pricing for this tier. However, similar prop firms charge $1,000-$1,100 for accounts this size. The price difference makes sense given the higher capital risk for the firm.

The company offers an 80% profit split whatever the account size. This puts them in a competitive position, as market splits usually range from 70-90%. With a $50K account, you keep 80% of all trading profits and GFunded takes 20%.

GFunded’s fee refund policy gives them an edge in prop firm evaluations. They offer 100% refundable fees for accounts of all sizes. This means successful traders could get their evaluation essentially free.

Different prop firms handle refunds in their own way. GFunded returns the full evaluation fee once traders show they can make consistent profits. Other firms like Goat Funded Trader wait until the fourth payout. This creates a long-term incentive to trade consistently.

The refund policy only covers the original evaluation fee. Extra services or add-ons usually don’t qualify for refunds. Some competitors like FundedNext Futures don’t offer refunds at all. This shows how GFunded puts traders first.

GFunded’s base packages come with useful add-ons that give traders more flexibility. News trading access comes standard with all plans. Traders can work during major economic announcements – something many other prop firms don’t allow.

Reset options are another vital add-on in the prop firm world. The documents don’t list GFunded’s reset prices, but industry standards run between $60-$80. These resets let traders restart their funded account after breaking rules, without buying a new challenge. You need to buy reset add-ons before any violations happen.

Weekly payouts have become popular among prop firms. This feature speeds up the normal payout schedule. Traders can ask for withdrawals every 7 days instead of waiting 14-30 days. Active traders who make steady profits can manage their cash flow better.

GFunded accounts also include weekend holding capabilities and 24/7 support. These features show they understand what traders need without charging extra for basic services.

Your choice of trading platform can make or break your prop firm journey. It will affect everything from execution quality to meeting profit targets. GFunded gives you several platform options, each with unique features that can shape your trading results.

TradeLocker works best for casual traders. It offers decent execution speeds. The platform suits traders who don’t rely on quick-execution strategies. You’ll find an accessible interface with auto-reconnect features and customizable technical indicators. The design focuses on ease of use rather than ultra-fast execution, making it perfect for newcomers or traders who prefer longer timeframe strategies.

MatchTrader stands out with exceptional performance metrics. Its ultra-fast matching engine can handle over 50,000 transactions per second with latency under 3 milliseconds. This speed becomes valuable during volatile market conditions when prices change faster. The platform’s mobile-first design lets you trade seamlessly across devices. Built-in TradingView charts boost your analysis capabilities.

DXTrade serves as a complete multi-asset solution for OTC brokers, listed securities, and crypto venues. Modern traders love its interface, and you can fully customize it to meet specific needs. Still, many traders stick to MetaTrader 4/5’s 15-year-old reliability. Newer platforms like MatchTrader, TradeLocker, and DXTrade sometimes face bugs and stability issues.

Trading costs play a vital role in prop firm success. Spreads between bid and ask prices directly hit your bottom line. Major currency pairs usually have tighter spreads than exotic ones. EUR/USD spreads can get close to zero when liquidity peaks.

Market timing changes spread width. You’ll see tighter spreads when London and New York sessions overlap, creating high liquidity. The spreads get wider during quiet hours and especially during major news events.

Prop firms usually offer two spread models:

Some firms like Atmos give you raw spreads with commissions. They charge about USD 5.00 per round lot on FX pairs. This clear pricing helps you calculate exact costs. Trading 1 lot of EURUSD with a 0.2 pip spread costs USD 2.00 in spread plus USD 5.00 in commission, adding up to USD 7.00.

Platforms prove their worth during market volatility. MatchTrader excels here by maintaining steady execution even when prices move fast. Traders using high-frequency strategies can get orders filled near their desired prices, which could improve overall profits.

TradeLocker performs well in normal conditions but struggles when speed becomes essential. This weakness shows up during news events or sudden market changes where every millisecond counts.

cTrader delivers quick execution without much lag. Sometimes it slows slightly during peak times like major economic announcements. These differences show why you should pick a platform that matches your trading style instead of following the crowd.

Platform selection matters, but knowing how each one works during your trading hours is just as important. A platform might work great during European sessions but lag during Asian hours due to liquidity differences. Testing execution quality in various market conditions will give you a full picture of what works best for your strategy.

The real reward comes after you pass your evaluation – taking profits from your funded account. A good grasp of the payout process will help you avoid delays and manage your account properly.

Your account dashboard has a dedicated “Payout” or “Withdrawal” section to start the process. Make sure you close all trades before submitting a request because open positions will trigger automatic rejection. The processing takes 24-48 hours, and then funds move to your chosen payment method. Most prop firms pay twice a month, usually on the 14th and 28th.

You’ll need to complete KYC verification before your first withdrawal. This security check needs:

The review takes 24-72 hours, and international traders might need extra documentation. You’ll also need a payment account, often through specialized platforms like RiseWorks that handle prop firm payouts.

Your payout could face delays due to various reasons. Missing verification documents and open positions are common roadblocks. Minimum withdrawal limits vary between $25 to $1,000 based on firm and account size, so you might need to build up enough profits first. Payment systems don’t run during market closures, so weekend requests process on the next business day.

Withdrawals change your trading risk parameters directly. Your available equity drops when you take out funds, which could reduce the gap between your balance and maximum drawdown limit. Many firms use a “Locked Upon Payout” rule that freezes your trailing drawdown at the starting balance after withdrawal. A trader with a $100,000 account growing to $120,000 who withdraws $16,000 will see their balance drop to $104,000. The drawdown stays locked at $100,000, leaving just $4,000 as buffer. This small margin raises the risk of hitting drawdown limits and breaking account rules.

Smart traders build big cushions before withdrawing or reduce their position sizes afterward. Some choose to withdraw everything after reaching breakeven to reset their account.

Your trading style and mindset largely determine your success with GFunded. The platform’s structure makes it clear who will thrive and who should look elsewhere.

Traders who show environmentally responsible trading habits usually excel with GFunded. These traders stick to risk-to-reward ratios of at least 1:2 and limit their risk to 1-2% per trade instead of chasing quick profits. Successful prop traders put capital preservation and controlled risk above everything else. Many traders struggle with their personal accounts but find that prop firm rules help them trade better by enforcing discipline they couldn’t maintain on their own.

Consistency is the life-blood of funded success. Traders who see drawdowns as part of the process rather than failures tend to perform better in the long run. The mental toughness to accept losses without revenge trading sets sustainable traders apart from those who eventually fail.

GFunded isn’t suitable for high-frequency traders. The platform bans trades held under 60 seconds, which makes HFT strategies impossible. Traders who use grid trading or aggressive scalping techniques risk account termination no matter how profitable they are.

GFunded’s parameters can feel too tight for traders who need more drawdown flexibility. Traders used to 25-40% account swings must adjust to much stricter 10-15% drawdown limits. Prop firms create these restrictions because they value predictable risk over occasional big wins.

Successful traders often point to GFunded’s disciplined approach as a key factor. One trader earned $83,658.28 but ran into trouble after his leverage dropped from 1:30 to 1:5. Another trader turned a $50,000 instant-funded account into a $1,500 payout in just two weeks by sticking to strict risk management.

Failed traders usually blame psychological factors rather than strategy problems. One trader said, “The challenge is real still, mostly within my head, not with my strategy”. This feeling runs through trader communities – rules aren’t the main hurdle, but staying emotionally disciplined under pressure is.

The platform works best for traders who balance patience with consistent execution, not those looking for overnight riches.

I’ve tested GFunded accounts from $50K to $200K, and I can say this prop firm keeps its promises for the right trader. GFunded’s one-time fee model and 80% profit split make it stand out, but you’ll need steadfast discipline and a good grasp of all trading rules to succeed.

The platform works best for methodical traders who value consistency over quick profits. My experience shows traders usually fail because of mental factors, not bad strategies. They just can’t keep their emotions in check during drawdowns. If you’re used to aggressive trading or big account swings, you should look elsewhere.

GFunded’s rules might look tough at first, but they help build professional trading habits. Daily loss limits and maximum drawdown rules make you use proper risk management – a skill that helps in all your trading, not just prop firm challenges.

Your trading style and risk tolerance should guide your account choice. The 1-Step model works well for confident traders with proven strategies. Many traders find the 2-Step evaluation easier to handle mentally. Instant funding drops profit targets but adds stricter risk rules that need rock-solid discipline.

The best part? GFunded’s withdrawal process pays real profits with fair verification rules. This sets good prop firms apart from sketchy ones – actual payouts prove their business model works.

GFunded isn’t perfect. Platform limits, payout timing, and strict rules can challenge even seasoned traders. But these hurdles seem small compared to the chance of trading serious capital without risking your own money.

The real question isn’t if GFunded works – it’s whether you can adapt to their system. Successful prop traders see these rules as helpful guidelines that boost performance. If you’re ready to accept these rules and build consistent trading habits, GFunded offers a solid path to professional trading without risking your capital.

Q1. Is trading with a funded prop firm account worth it? Trading with a funded prop firm account can be worthwhile, especially for traders with limited capital. It allows you to access larger trading accounts without risking your own money, providing an opportunity to prove your skills and potentially earn significant profits. However, success depends on your trading ability, discipline, and adherence to the firm’s rules.

Q2. How do GFunded’s account types differ? GFunded offers three main account types: 1-Step, 2-Step, and Instant Funding. The 1-Step model is a fast-track option with stricter rules, the 2-Step model provides a more gradual evaluation process, and Instant Funding grants immediate access to a funded account with tighter risk parameters. Each type caters to different trading styles and risk tolerances.

Q3. What are the key rules to follow when trading with GFunded? Important rules include meeting profit targets (typically 10% of account balance), adhering to daily loss and maximum drawdown limits, maintaining consistency (no single day’s profit exceeding 20% of total profits), and following minimum trading day requirements. Additionally, there are restrictions on news trading and requirements for using stop-losses.

Q4. How does the payout process work with GFunded? After passing the evaluation and meeting consistency requirements, you can request a payout through your account dashboard. The process involves closing all open positions, completing KYC verification, and potentially setting up a payment account. Payouts are typically processed within 24-48 hours, subject to the firm’s payout schedule.

Q5. Who is best suited for trading with GFunded? GFunded is best suited for disciplined, consistent traders who can manage risk effectively. It’s particularly beneficial for those with limited personal capital but strong trading skills. However, it may not be ideal for high-frequency traders or those using strategies that require significant drawdown flexibility. Successful prop traders often view account rules as beneficial guidelines rather than restrictions.