Prop firms give traders access to substantial capital and pay out 70% to 95% of the profits. This business model has become popular because traders worldwide can trade with money that’s nowhere near what they own, and they can do it all online.

These companies let you trade multiple assets including forex, stocks, crypto, commodities, and more. The way prop firms make money is straightforward – they collect evaluation fees upfront. Some firms can collect up to $5,000,000 if 10,000 traders pay $500 each. The evaluation process tests both performance and trader behavior.

This piece breaks down every aspect of prop trading. You’ll learn about evaluation processes, payout structures, risk management requirements, and the pros and cons of this unique trading setup. The information here will help you understand the industry better, whether you want to start your first prop firm account or just want to know more about how it all works.

Proprietary trading firms have become increasingly popular in financial markets, especially as online trading continues to grow. Traders need to learn about their structure, operations, and how they work to make smart decisions about their trading career.

Proprietary trading (prop trading) is a financial model where companies trade with their own capital instead of making trades for clients. Modern digital prop firms let independent traders join their funding model after they pass evaluation phases or trading challenges.

These firms aim to find skilled traders who can make profits using the firm’s money. They give traders access to large trading funds—sometimes up to $1 million. This lets traders execute strategies with bigger position sizes than they could with their own money.

Traditional prop firms started as physical offices where traders worked on-site with company money. The online prop firm model has reshaped the scene by giving remote traders worldwide access to institutional-level capital without location restrictions.

The main difference between prop trading and brokerage comes down to who owns the money and takes the risk. Traders using brokers risk their own money and take full financial responsibility. Prop firms provide their capital once traders show they have the right skills.

Key differences include:

Many traders choose prop firms even though they share profits. This is a big deal as it means that getting 80% of profits from a $200,000 account is often better than keeping all profits from a smaller personal account.

Prop Firms

Prop firms come in many shapes and sizes, with some focusing on specific markets while others trade multiple assets. Their focus affects how they operate, evaluate traders, and share profits.

The forex market has lots of prop firms, showing how popular and accessible currency trading has become. These firms let traders hypothesize on currency movements with high leverage and round-the-clock market access.

Stock-focused prop firms help traders who like equity markets. They provide capital to day trade, swing trade, or position trade stocks and indices. Traders often get advanced charting tools and level 2 market data.

Crypto prop firms are newer but growing faster. They help traders navigate volatile cryptocurrency markets. Since crypto trades 24/7, these firms often have special rules about trading hours and risk management.

Many prop firms now offer platforms for trading multiple assets including futures, commodities, and indices. Traders can use their strategies in different market conditions and asset types.

A prop firm’s capital becomes available to traders after they complete an evaluation process. This assessment tests both skills and trading behavior. Most prop trading firms ask prospective traders to prove themselves through structured challenges before they can access funded accounts.

The prop firm challenge is the life-blood of proprietary trading operations. Traders must prove their worth in a controlled environment before they can access simulated capital. This evaluation filters disciplined traders, protects the firm’s money, and verifies consistent performance.

Everything starts when a trader buys an evaluation account. They need to show profitable trades while staying within strict risk limits. This original step happens in a simulated environment that matches real market conditions. This setup lets firms evaluate trader performance without risking actual money.

Numbers show that only 5-10% of traders pass prop firm challenges. These tests go beyond just checking profitability. They get into a trader’s risk management skills, consistency, and knowing how to follow structured rules.

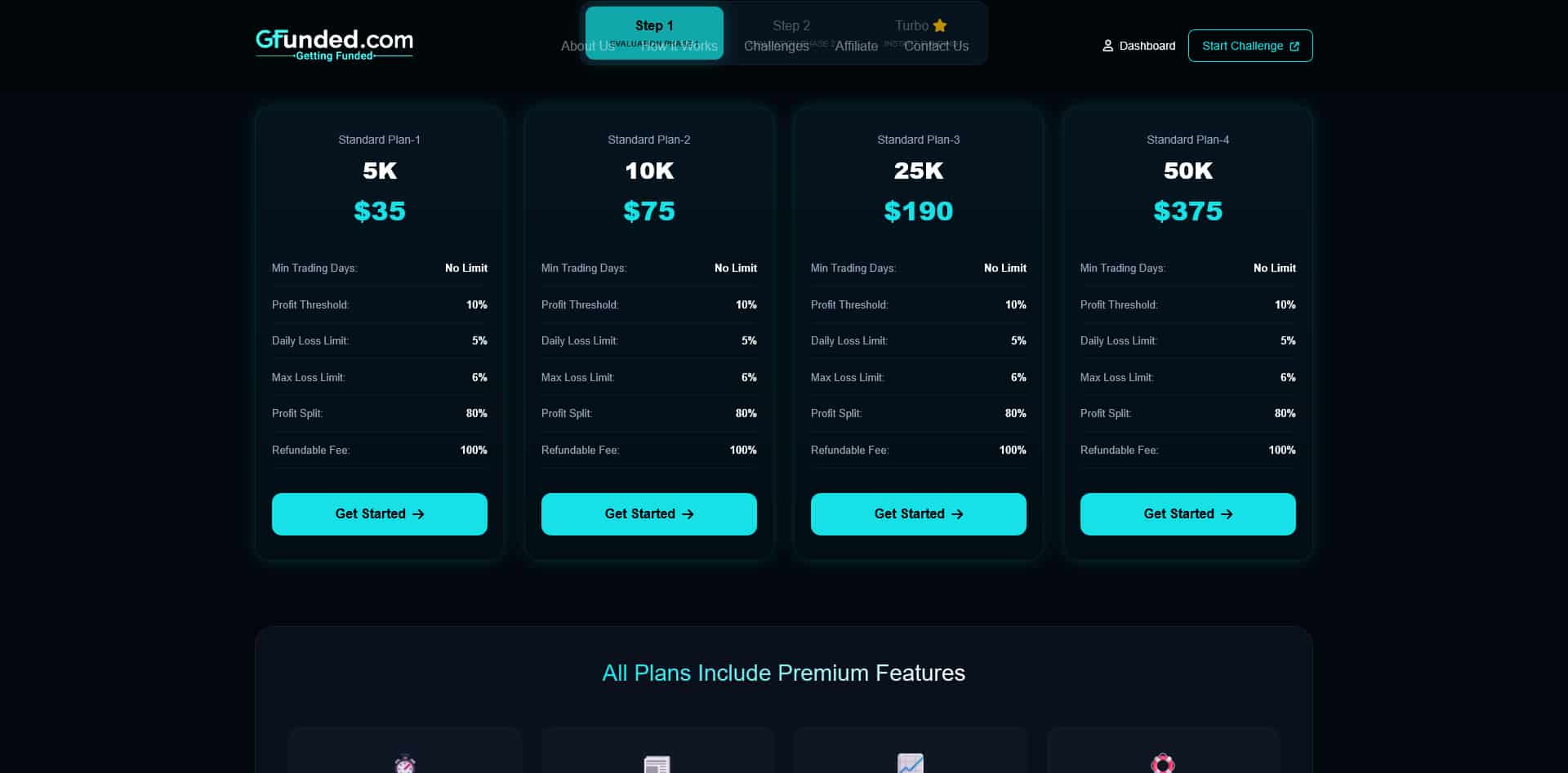

Prop firms employ several evaluation structures with specific requirements and timeframes. The one-phase challenge packs the entire evaluation into a single stage. Traders need to hit profit targets (usually 8-10% of account value) without breaking risk rules. Traders who want faster funding often choose this format.

The two-phase model has become standard practice in the industry. The first phase needs a higher profit target (7.5-12%). The second verification phase requires a smaller target (around 5%) under identical risk conditions. This approach proves that traders can deliver steady returns instead of getting lucky with a few trades.

Some firms use three-step challenges to name just one example of a detailed assessment. These add a consistency phase with a 3-4% profit target. This phase focuses on steady trading performance over time. Across all formats, profit targets usually fall between 6% and 15% of account value.

Risk management rules are the foundations of prop firm challenges. The main risk parameters include:

The way firms calculate drawdowns affects the trading experience by a lot. Some firms look at closed trades only. Others watch floating (unrealized) equity that includes open positions. The challenge fails right away if a trader breaks these limits, whatever their overall profits.

Traders who complete all evaluation phases get a funded account, but the process differs between firms. Some companies approve accounts automatically when the market closes on target-hitting days. Others review everything manually.

Most traders end up with profit-sharing deals that split earnings 50% to 90% in their favor. These funded accounts follow the same or similar risk rules as the challenge phases. This approach keeps traders disciplined.

Firms often give successful traders chances to handle more capital. Some prop firms move traders to live capital accounts after three successful payouts or big total withdrawals.

This structured evaluation system helps prop firms find traders who can deliver steady returns while following professional risk rules. The system protects their capital and creates opportunities for skilled traders at the same time.

The real fun starts after you pass a prop firm’s evaluation – you get your share of the profits. Traders need to learn about payout structures to make the most money from their funded accounts.

Profit splits are the life-blood of prop trading. Most firms give traders 70% to 80% of their generated profits. The best firms are even more generous. Some offer up to 90%, 95%, or in rare cases, 100%. These splits can affect your earnings by a lot.

The same firm might offer different profit-sharing percentages based on account types, performance metrics, or scaling status. Your share could start at 50% and grow to 80% or higher as you prove yourself. The catch? Higher profit splits often mean tougher trading rules or bigger evaluation fees.

Your cash flow depends on how often the firm pays out. Most prop firms pay bi-weekly or monthly. Some competitive options include:

You’ll usually wait 1-7 business days to get paid. Premium firms like My Funded Futures approve most requests right away. The timeline depends on your payment method and the firm’s review process.

Prop firms have rules before they release your profits. Common requirements include:

Many firms lock your maximum loss limit after your first withdrawal. This protects their money while letting you keep trading.

You can get paid in several ways, each with its own speed and fees. PayPal and RiseWorks are popular because they’re fast and have lower international fees. Bank transfers are reliable but slower and more expensive.

Crypto payouts, mainly in USDT, are becoming more common. They offer quick settlements with tiny fees across borders. Check if your preferred payout method works with the prop firm you choose. Available options vary by region and provider partnerships.

Prop Firms

Prop firms have sophisticated revenue models that go way beyond the reach and influence of just sharing profits with traders. Their polished websites and professional presentations don’t tell the whole story. Let’s look at how prop firms make money and why these businesses stay profitable even when most traders fail.

Evaluation fees are the biggest money maker for most retail prop firms. These upfront payments can cost anywhere from $50 to over $1000 based on account size and how tough the evaluation is. Since all but one of these traders fail prop firm challenges (only 5-10% pass), these fees add up fast. A prop firm with 10,000 funded traders could collect $100,000,000 in one-off evaluation fees if each funded account needed 100 failed attempts at $100 per challenge.

Prop firms also make money through “second chance” options. Traders who break risk parameters can buy reset add-ons instead of starting over. These resets usually cost $60-$80 for futures firms or up to $499 for funded accounts. The firms also sell various add-ons like profit split improvements, trailing drawdown changes, and consistency rule adjustments at checkout. Alpha Trader Firm’s reset feature lets traders restart a funded account with similar terms after a standard breach.

The profit sharing part isn’t as big as you might think – it’s actually a smaller piece of the pie compared to evaluation fees. Prop firms keep 10-30% of their successful traders’ profits. This arrangement helps both the firm and trader while creating steady income from traders who consistently make money.

Many firms boost their income through strategic collaborations as introducing brokers (IBs) and earn commissions from trading volume. Some add a markup to spreads or charge subscription fees for premium features. Newer methods include exploiting trader behavior patterns to create proprietary algorithms for company accounts. This informed approach shows how prop trading firms are finding new ways to create value beyond their usual fee structure.

Trading with proprietary firms offers both opportunities and risks for investors. You should know what you’re getting into before starting this financial journey.

Prop firms let traders access substantial capital—up to $200,000 after passing evaluations. Most traders would never see this kind of money otherwise. The model helps reduce financial risk since traders only risk their evaluation fee instead of their entire savings.

These firms offer several key benefits:

Numbers tell a tough story: only 5-10% of traders pass prop firm evaluations. A mere 7% of funded accounts receive any payouts. Prop trading requires you to follow strict capital rules—daily loss limits stay at 5% while maximum drawdowns hit 10%.

Traders also deal with profit-sharing limits and sometimes unclear policies from firms. The reliable infrastructure might tie you down. Many traders end up playing it too safe instead of using their edge.

Three types of traders fit well with prop trading: newcomers who need structure, profitable traders ready to scale up, and funded traders running long-term accounts. This path works best when you have limited personal capital but know how to manage risks.

Success requires keeping risk at 0.25-1% per trade with a risk-reward ratio of 1:2 or better.

Prop trading gives traders a chance to access substantial capital without risking their own savings. This piece explores how these firms work – from their evaluation process to payout structures and business models. Both parties can benefit from this unique trading setup, but success demands discipline and skill.

The numbers tell the real story – only 5-10% of traders complete challenges successfully. Even fewer keep their funded accounts for the long run. Many prop firms’ revenue strategy actually counts on this high failure rate, along with evaluation fees and add-on purchases.

Smart traders who tackle prop trading head-on can find real advantages. They get access to capital they couldn’t reach otherwise and keep 70-95% of their profits. The well-laid-out environment helps traders build disciplined habits that serve them throughout their careers.

Your trading style, risk tolerance, and capital situation determine if prop trading lines up with your goals. New traders value the learning structure. Experienced traders love the scaling possibilities. Starting with smaller account sizes makes sense whatever your experience level. This helps you cut evaluation costs while you get used to the firm’s rules.

The digital world of prop trading changes faster every day. Firms keep adjusting their offerings to stay ahead. Smart traders compare multiple providers before they commit. They focus on transparent firms that have consistent payout track records and achievable profit targets.

Prop trading won’t turn a losing strategy into a winner – but it can substantially boost returns for disciplined traders with proven methods. Finding the “perfect” prop firm matters less than developing consistent trading skills that work within these firms’ risk parameters.

Understanding prop firm trading can unlock access to substantial capital while minimizing personal financial risk, though success requires discipline and realistic expectations about the challenges ahead.

• Prop firms provide traders access to $200,000+ in capital while keeping only evaluation fees at risk, sharing 70-95% of profits with successful traders.

• Only 5-10% of traders pass prop firm challenges, and just 7% of funded accounts ever receive payouts due to strict risk management rules.

• Firms generate revenue primarily through evaluation fees ($50-$1000+) and resets, not just profit sharing from the small percentage of successful traders.

• Success requires disciplined risk management (0.25-1% per trade), consistent profitability, and ability to follow strict drawdown limits and daily loss restrictions.

• Prop trading suits three groups: beginners seeking structure, profitable traders wanting to scale, and those with limited personal capital but proven trading skills.

The prop trading model creates a win-win scenario when approached correctly – firms identify skilled traders while providing capital access that would otherwise be impossible for most individuals. However, the high failure rates underscore that prop trading amplifies existing skills rather than creating them, making it essential to develop consistent profitability before pursuing funded accounts.

Q1. How do prop firms make money if traders are successful? Prop firms generate revenue through multiple streams, including evaluation fees, reset and add-on purchases, and profit sharing from successful traders. They also benefit from partnerships with trading platforms and may monetize trading data.

Q2. What happens if I lose money in a prop firm account? If you exceed the maximum drawdown limit set by the prop firm, your account will be closed. You are not responsible for repaying any losses beyond your initial evaluation fee. The firm’s risk management rules are designed to limit their exposure.

Q3. How does the evaluation process work for prop firms? Typically, traders must pass a multi-stage evaluation, often including a challenge phase and a verification phase. Each stage has specific profit targets and risk management rules. Only after successfully completing these stages can a trader access a funded account.

Q4. What percentage of profits do traders typically keep? Most prop firms offer profit splits ranging from 70% to 95% for the trader. The exact percentage can vary based on the firm, account type, and trader performance. Some firms increase the profit share as traders demonstrate consistent success.

Q5. Are prop firm accounts suitable for beginner traders? While prop firms can provide access to larger capital, they are generally more suitable for traders who already have a consistent and profitable strategy. Beginners may benefit from the structured environment and risk management rules, but should be aware of the high failure rate and potential loss of evaluation fees.